The College Investor podcast is a daily audio show that’s dedicated to bringing you the best of TheCollegeInvestor.com. We discuss a variety of topics, all relating to millennial money. Robert Farrington, the founder of The College Investor and a Millennial Money Expert, shares how to get out of student loan debt so that you can start investing and building wealth for the future. Instead of cutting expenses and living a frugal life, he advocates side hustling and entrepreneurship to earn extra money to achieve your financial goals.

Financial aid can provide students with access to educational options they may not have otherwise had. But sometimes, students are denied additional financial aid, even after making an appeal.

If you appealed for additional financial aid, but your appeal was denied, you still have a few options. In this article, we'll let you know what steps you can take to try and secure more financial aid. We'll also provide you with some alternative places to look for money.

Your first step should be to confirm that you filed a proper appeal, based on documented special circumstances that affect your ability to pay for college.

If your appeal was just a request for more money without any justification, don't be surprised that your appeal was denied. Bluff and bluster will not get you a better deal. Boilerplate appeals don’t work. Your child may a wonderful person with great grades, but that won’t get you more need-based financial aid.

You need to understand how to file a proper appeal. The special circumstances that are most likely to lead to a successful appeal involve job loss and pay cuts, not home-baked chocolate chip cookies.

Next, ask the college financial aid administrator for the reasons why your appeal was denied.

What can you do differently next time? What are the next steps? Ask about other options for paying for college.

You can submit another appeal, but only if you have information about a new special circumstance that may justify an adjustment. The new appeal letter should highlight what has changed since the previous appeal letter.

Let the financial aid administrator know if there are special circumstances that weren’t mentioned as part of your original financial aid appeal.

You can defer enrollment for a year. This is a good option if it will lead to a more generous financial aid package. A new year means a new application for financial aid. The base year will change, which may cause the financial aid offer to change, especially if your income changed.

However, if the student uses the gap year to earn money to pay for college, the increase in income may lead to less financial aid.

Instead of deferring enrollment, consider enrolling at a more affordable college. If you applied to a mix of colleges, you may have been accepted by a less expensive college, such as an in-state public college or a community college.

If you applied only to expensive out-of-state colleges, you may be out of luck, although there are several hundred colleges that accept late applications for admission. There are also colleges with rolling admission.

Don’t count on returning to the original college after a year or two in a less expensive college. If you take classes in a community college during the gap year, you will be considered to be a transfer student after the deferment ends, and many colleges provide less financial aid to transfer students.

If you are already in college, but the financial aid package for a subsequent year is inadequate, consider transferring to a less expensive college. About half of colleges practice front-loading of grants, where the grants are more generous during the first year, yielding a lower net price than in later years.

If you didn’t apply for financial aid as a first-year student because the college had a need-sensitive admissions policy and you figured that you could wing it for a year, you may be ineligible for institutional grants from the college in subsequent years.

Colleges don’t like it when families try to game the system. They may waive this policy, but only if you can demonstrate a big change in your family’s financial circumstances.

There are several places you can look for additional money that can help you pay for school.

You can also sign up for financial counseling with a non-profit credit counselor. Sometimes, financial challenges can be caused by money management issues. A financial counselor will teach you how to manage your money instead of having your money manage you. They can help you create a budget which will free up cash to help pay for college.

Too often students apply only to selective colleges and are surprised when the net price is more expensive than they can afford. The net price subtracts grants from the cost of attendance. It is the amount you’ll have to pay from savings, income and loans.

When crafting your college list, use each college’s net price calculator to get a personalized estimate of the college’s net price.

Apply to a mix of colleges, including a financial aid safety school, which is a college you can afford to attend even if you get no financial aid. Often, an in-state public college will be your least expensive option.

Apply to colleges that rely on the FAFSA for institutional aid, not just colleges that use the CSS Profile.

A student can lose eligibility for need-based financial aid by failing to maintain Satisfactory Academic Progress (SAP). Students must maintain at least a 2.0 GPA on a 4.0 scale and be taking and passing enough classes to be on track to graduate within 150% of the maximum time-frame (e.g., 6 years for a 4-year degree). You can lose financial aid eligibility due to poor academic performance.

You can appeal the loss of financial aid when the failure to maintain SAP is due to extenuating circumstances, such as death of a relative, severe injury or illness of the student, domestic violence, unusual financial circumstances (e.g., student or parent job loss, death of a parent) or other special circumstances as determined by the college.

Independent third-party documentation of the special circumstances may be required, or the appeal will be denied. If your appeal was denied, you can appeal again if you have addressed the issues that caused you to fail to maintain SAP.

A borrower may be denied a Federal PLUS loan if they have a poor credit history. An adverse credit history involves a current delinquency of 90 or more days on $2,085 or more debt, debts totaling $2,085 or more in collections or charged off, or certain derogatory events in the last five years (e.g., bankruptcy discharge, foreclosure, repossession, tax lien, default determination, wage garnishment).

If the only reason for the PLUS loan denial is due to a current delinquency, you can regain eligibility by bringing the delinquent account current. As soon as this shows up on a credit report, you will be eligible for the PLUS loan.

If one parent is denied a PLUS loan because of an adverse credit history, have the other parent apply if they don’t have an adverse credit history.

You can also appeal based on extenuating circumstances, such as not being responsible for repaying the debt (e.g., due to divorce), the debt was paid in full, the debt was discharged in bankruptcy (Chapter 13 only), the debt was rehabilitated or you have made satisfactory arrangements to repay the debt, or the credit report contains errors that lead to the adverse credit history finding.

You can qualify for a PLUS loan if you get an endorser, which is like a cosigner, who does not have an adverse credit history. The endorser cannot be the student.

Finally, if a parent is denied a Parent PLUS loan, the student becomes eligible for the higher loan limits available to independent students.

Editor: Colin Graves Reviewed by: Robert Farrington

The post What To Do If Your Financial Aid Appeal Is Denied appeared first on The College Investor.

So you’re considering joining Greek life. The biggest question on your mind is how much joining a sorority or fraternity is going to cost you.

Every school is different. Depending on where you go and the prestige of the organization you join, Greek life can run anywhere from a thousand to tens of thousands of dollars every semester. This includes membership dues, room and board if you live in the house, as well as miscellaneous costs like your ticket to the spring formal or participating in a philanthropy event.

Before you join Greek life you’ll want to crunch the numbers to make sure it fits in your budget. Here are some of the biggest costs of joining a sorority or fraternity and maybe it can help you decide if you go greek or stay geed in college.

Before you even join a sorority or fraternity you’ll have to register for formal recruitment also known as rush. This is a process where potential new members – called PNMs – visit different Greek houses. Rush lasts several rounds before culminating in Bid Day when a Greek organization issues a formal invitation for a PNM to join their house.

The registration fee for rush can vary by campus. At the University of Alabama – well known for its Greek culture – a ticket to participate in sorority recruitment costs $375. Meanwhile, rushing a fraternity at a school like North Carolina State University will only cost you $65.

There are other expenses associated with rush that can increase the cost too. You’ll have to follow a dress code for each round of the process. If you’re trying to join a more prestigious house, be prepared to fork over some cash to build a wardrobe around top name designer brands.

At schools where rush is a highly competitive process, some PNMs go the extra mile by hiring professional consultants and mentors. A sorority rush consultant, for example, can cost upwards of $3,500. That means before you’re even an official member of Greek life you could wind up spending several thousand dollars just to join an organization.

Once you become a member of a house you’ll be on the hook to pay dues. These dues go to the national organization you’re part of, the local chapter you’re a member of, as well as dues to umbrella organizations like the National Panhellenic Conference. New members can expect to pay higher dues during their first year as they transition from pledge to active member. Dues vary by house and can range from a couple hundred dollars per semester to a couple thousand.

Aside from dues, room and board is one of the most expensive parts of joining a fraternity or sorority. Most Greek life organizations maintain residential houses. Rather than living on campus, you can live in your house instead.

Depending on your house and the expectations of your campus, you may or may not have a housing requirement. In some cases, living in your sorority or fraternity house might be comparable to living in a campus dorm. In other cases, you might forfeit the opportunity to live in a cheaper off-campus apartment if you have to fulfill your sorority or fraternity’s housing requirement.

Most houses also come with a staffed kitchen which means you’ll be on the hook for paying rent as well as maintaining a meal plan. Even if you don’t live in the house, you might still be expected to have some sort of meal plan, especially if a chapter meal is included as part of your membership.

Greek life is known for social events and parties. Whether it’s spring formal or a themed event, parties cost money. Some houses have a budget for social activities but not everything is included. Formal events, for example, are usually hosted off campus. These are more expensive and you’ll probably have to pay out of pocket to attend. Not to mention you’ll want to dress up for the occasion.

If you’re trying to figure out how much joining a fraternity or sorority is going to cost you, talk to existing members to get a sense of what their social expenses are. If you wind up joining a house that likes to party it can cost you over the course of your college career.

Once you join a Greek organization you’ll be expected to look the part too. Instead of wearing pink on Wednesdays, you might have to wear your Greek letters. Expect to pay out of pocket for hoodies, t-shirts, bags, and other gear to represent your organization.

One important thing to note is that sororities and fraternities are ritualistic organizations. You’ll have a dress code for chapter meetings which includes wearing your badge. Depending on your budget, you can get a cheap badge or splurge on a Tiffany-set badge. Just keep in mind that there’s a lot of peer pressure in Greek life. You might feel the urge to buy gear that is outside of your budget just to fit in.

Speaking of rituals, if you’re planning on joining a fraternity or sorority you might want to keep a sinking fund for penalties. Some organizations charge fees if you’re late to an event or skip out on a chapter meeting. Think of fines in Greek life like getting a parking ticket in the real world. They’re annoying and you don’t intend to get them but life happens and you do.

In addition to formal, formal events, you’ll also need to budget for informal formal events. Think spotting a sister the next time you pop into Starbucks or picking up the tab next time you and the brothers go out. These are things you’d expect to pay for during your college career but the cost can increase when you join a fraternity or sorority thanks to the social element of these organizations.

Again you will want to fit in so at some point it’ll be your turn to cover the cost for something, even if it’s not in your budget. Plan on these types of little expenses when you’re considering whether or not to join a fraternity or sorority.

Once you graduate from college and your Greek days are behind you, you’ll still be on the hook to pay dues. To be eligible for alumni benefits you’ll have to pay fees as an alumni. These dues double as donations and can be tax-deductible. Fortunately, they’re much cheaper – in some cases less than $100 per year.

Depending on what your goals and expectations are, joining a sorority or fraternity can be worth the cost.

Greek life provides an entire social network during college, not just with the house you join but with other Greek houses on campus too. These groups not only provide lifelong friendships but they can establish important professional relationships too. According to Cornell University’s student-run newspaper, 80% of top executives of Fortune 500 companies were members of fraternities during their college years.

That being said, there are other organizations on campus that provide the same benefits as Greek life for a fraction of the cost. You can join an academic group or a club sports team and develop relationships that can also help you land a job or build lasting friendships too.

If you’re set on joining a fraternity or sorority and you aren’t independently wealthy, you’ll want to develop a plan to pay for it. The good news is you have lots of options. The bad news is not all your options are going to be good ones. Here are a few ways to pay for Greek life.

When you join you’ll probably get information about the costs broken out by semester. This can be a lot of money upfront and can be hard to balance with your tuition bill. Talk to your organization to see if they can put you on a payment plan. This can help break up payments throughout the calendar year rather than by the academic year.

Like college admissions, Greek life offers scholarships and grants that can offset the cost of joining. Some scholarships are offered by specific Greek organizations while others are offered by umbrella organizations like the Interfraternity Council. These can be quite competitive and you might need to join a Greek organization first before you’re eligible to apply.

Depending on your financial aid package, you might be issued a refund by your school’s bursar’s office. This money is intended to cover costs not directly billed by your school such as books. It can also be used for other expenses like housing or Greek life.

Even though this might feel like free money it isn’t really. You’ll be on the hook for paying it back, with interest, once you graduate. While you technically can use it to cover Greek life dues and expenses, just be mindful that it’ll cost you later on.

Similar to your student loan refund, credit cards or other lines of credit can also be used to cover expenses associated with Greek life. While your credit limit might not cover the full bill, it can cover things like trips to Starbucks or buying a dress for formal.

Be mindful that you’ll have to pay all that back at double-digit interest rates. If you’re new to credit cards and are unsure how to budget, it can lead you into debt very quickly.

Once you join Greek life you might be surprised to learn that many Greeks aren’t independently wealthy. In fact, a lot of Greeks work part-time jobs to cover their costs. This can actually work to your advantage. If you work at a late-night dive and can bring leftovers back to the house after your shifts, your brothers and sisters will love you.

Joining a fraternity or sorority isn’t cheap. There are a lot of extra costs beyond just paying dues. Before joining you’ll want to create a budget. In your budget, think about the extra cost of living in the house and participating in social activities. While Greek life can be a good investment, it’s only a good one if you can afford to take advantage of it. If you’re too broke to socialize with your brothers or sisters it might not pay off in the way you hope it will.

The good news is not all Greek organizations have to cost an arm and a leg. There are service organizations like Alpha Phi Omega and a whole host of social clubs on campus that provide many of the same benefits as Greek life for a fraction of the cost. Evaluate the costs and figure out what makes sense for you before joining.

Editor: Ashley Barnett Reviewed by: Robert Farrington

The post How Much Does It Cost To Join A Sorority Or Fraternity appeared first on The College Investor.

Aside from getting good grades, college is a time to build relationships and establish lifelong friendships. Maintaining a social life can help you find balance between living and learning.

Greek life is one of the easiest ways to create a social network in college. Depending on where you go to school, joining Greek life may also be one of the most significant decisions you make as an undergrad too.

You might be wondering if you should go Greek? Before you rush in, these are some things you’ll want to consider first.

Greek life is a popular social system on college campuses. It consists of fraternities and sororities that use the Greek alphabet to distinguish one organization from another. Students who are members of Greek life often wear the Greek letters of the organization they are part of.

Greek life is most well-known for its rigorous recruitment process, partying, and hazing. But that isn’t all it has to offer. It also consists of academic, professional, and service-oriented organizations that provide community for its members. This includes Phi Beta Kappa, the oldest — and possibly the most prestigious — Greek organization in the United States.

Each college campus approaches Greek life differently. Some organizations maintain exclusive houses where members live. Others operate more informally. Greek houses host regular meetings as well as social events.

The individual chapters on college campuses are part of larger national organizations. There are also governing bodies that manage Greek life across the country. This includes the National Panhellenic Council and the North American Interfraternity Conference.

Regardless of which organization a student is part of, the goal of Greek life is usually the same. It helps undergrads develop leadership skills, provides social activities, and holds them accountable for academic achievement.

Going Greek is one of the easiest ways to have a social life during your college career. On some campuses, it's the only way. Aside from that, it can help you build skills you won’t learn inside a classroom while providing a support system too.

Greek life gives you access to leadership opportunities you might not find at other social organizations on campus. Most chapters hold elections for roles like president or social chair. Depending on the role, you may liaise with other houses to plan joint events. Governing bodies like the National Panhellenic Council recruit from Greek life organizations and can help you establish yourself as a leader on campus while building your resume too.

Soft skills are becoming increasingly important in the workplace. According to a 2019 survey by LinkedIn, 91% of recruiters and HR professionals identified soft skills as a trend transforming the future of work.

Soft skills include things like creative problem-solving, communication, and being able to work as a team. Your college classes may not provide an opportunity to develop these critical skills, but Greek life will. This can pay off big in the future if you pursue a career that values soft skills and social connections.

Greek life is most well known for the social value it provides. Your brothers or sisters often become lifelong friends and many Greek organizations maintain robust alumni networks that you can join after you graduate.

While getting good grades in college is important, building relationships is important too. Believe it or not, as many as 85% of jobs are filled through networking. Fraternities and sororities don’t just provide friends to hang out with on the weekends, they establish relationships that can pay dividends later in your career.

Greek life makes volunteering fun. Events might include partnering with another organization giving you the chance to socialize with other Greeks in a more informal setting. Philanthropic activities can range from all-night dance-a-thons to eating contests.

While there are some good reasons to go Greek, it isn’t for everyone. These are some drawbacks to consider before joining.

Be prepared to pay up if you go Greek. You’ll be expected to pay membership dues and many organizations have a housing obligation. Depending on where you go to school, this can be more expensive than living off campus.

The costs of going Greek may vary by campus and culture. In the south, where Greek life is more important, joining a fraternity or sorority can add tens of thousands of dollars to your college bill. In other regions where it’s less important, you may end up only paying a thousand bucks a semester.

There are other incidental expenses to consider too. You’ll have to pay for Greek gear to rep your house, gifts for new recruits, social events, and spotting your sister on your next trip to Starbucks. These costs might not seem like a lot, but over the course of your college career, they’ll add up.

Related: How Much Does it Cost To Join A Fraternity or Sorority

Unless you join a strictly academic organization like Phi Beta Kappa, Greek life has a stigma for its party culture. This is especially true for fraternities. While partying is part of the college experience, Greek life can take it to extremes.

Aside from throwing wild parties, Greeks are also known for hazing. After rushing a sorority or fraternity, new recruits go through a multi-week initiation process. Hazing is usually incorporated into that process, where pledges have to complete a series of tasks before being formally initiated.

These tasks can be innocent — like completing a scavenger hunt — but for some Greek organizations, they can involve dangerous levels of drinking. A hazing ritual led to the death of a freshman pledge at Cornell University in 2019, resulting in the fraternity getting kicked off campus.

While hazing is an open secret on most college campuses, Greeks are tight-lipped about the actual rituals. Once you become a pledge, you might be peer pressured into completing a ritual even if you think it’s humiliating or dangerous. This can compromise your values and make it hard to show up as your authentic self.

To be a member of a Greek organization in good standing, be prepared to sacrifice a lot of your free time to meetings and events. Once you’re initiated, you’ll have to participate in weekly chapter meetings, social events, and fundraisers throughout the year.

If you are in a rigorous academic program or work a part-time job, this can be difficult to balance. Greek life puts pressure on your limited time, which could impact your grades. Plus, to enforce participation, some Greek organizations even charge financial penalties if you miss chapter meetings or skip certain events.

Depending on your goals, Greek life might be worth it. The social aspect of Greek life is a big draw. It provides you with a solid network of friends when you are going through one of the biggest transitions in your life. These friends can turn into valuable relationships that may help land your dream job in the future.

On campuses where Greek life is the primary social network, not joining could make you feel left out. While grades are important, you don’t want to spend your entire undergrad career holed up in the library. Greek life provides a balance between academics and having fun.

But Greek life isn’t for everyone. The cost is a huge barrier to entry. On some campuses, Greek life is a tiered system. If you join a less desirable house, it might not build the social capital to make it worth the investment.

The expectation to party and participate in risky behavior is also a major drawback. Compromising your values just to have friends can impact your grades or worse, lead you down a path towards addiction and substance abuse.

Before you join, consider whether or not the costs are worth the benefits. Depending on your career goals or your desire to have a robust social network, Greek life may be worth the costs in the long run.

Deciding whether or not to join Greek life is an important — and expensive — decision you’ll have to make just as you’re beginning your college career. It isn’t for everyone and that is OK.

Greek life is part of college, but it isn’t the whole college experience. Schools offer a variety of clubs and social groups that come with many of the same benefits as Greek life, like building friendships and pursuing leadership opportunities. Joining these groups can be a low-cost alternative to Greek life and you may find that they align more with your lifestyle too.

Editor: Ashley Barnett Reviewed by: Robert Farrington

The post Should You Go Greek or Stay Geed? appeared first on The College Investor.

Acceptance rates at top colleges and universities are dropping every year. Business Student, a business education website, reported that acceptance rates at the top 50 schools fell from 35.9% in 2006 to 22.6% in 2018. And those trends only seem to be accelerating since Covid hit.

However, the trend isn’t universal. The Common App reports that 73% of its 914 member institutions admit more than 50% of all applicants. This is up from 69% in the 2014-2015 school year.

The craziest part of this trend is that the number of students enrolling in college has been steadily declining since 2010. How can declining enrollment fit together with lower acceptance rates? We dug into the numbers to understand the phenomenon.

The driving factor behind declining acceptance rates at top schools is the growth in the number of applicants at these schools. Top schools which include major research universities and private liberal arts schools are seeing a massive growth in the size of their applicant pool. While the number of people applying to college remains steady, the number of people submitting applications to many top schools is growing.

The ease of applying to selective schools may be part of the story. According to research from the Common App, an application used by over 1000 member universities, the average number of schools a person applied to through Common App jumped 8% between 2019 and 2020. This was the highest individual growth year, but the trend towards students applying to more schools has been a growing trend for years. In 2013-2014, students submitted 4.63 college applications on average. In 2021-2022 that number grew to 6.22.

Not every school is seeing these huge gains. Nearly three out of four colleges still admit more than half of all students who apply.

However, the most selective schools are seeing more applications, and many of the applications are coming from top students. Top students (those with strong academic performance and high standardized test scores) are applying to more schools than typical high school graduates. That means top schools don’t have to accept such a high proportion of students to fill their incoming classes.

Test-optional refers to a trend where an applicant can decide whether to submit a standardized test score with their application. Historically, most schools required students to submit either an ACT or SAT score. Today, fewer schools require students to jump through that hoop. Most schools that have dropped the standardized test score cite improvements to the diversity of their applicant pool as the driving factor behind their decision. Cynics point out that dropping the test score requirement drives up the number of people applying which gives schools the appearance of being more selective.

Whatever the reason, test-optional has undoubtedly led to more students applying to schools without a test score. In particular, the most selective universities are seeing more applications than ever before.

While some universities took a test-optional stance as early as the early 2000s, most schools were forced to become test-optional during the 2020-2021 school year due to the COVID-19 pandemic shutting down testing sites. Since that time, many schools have kept their test-optional status, and students are submitting test scores far less frequently than they did before the pandemic.

Some schools have taken the test-optional trend a step further. For example, the California higher education system no longer accepts test scores as part of its application process. Top students looking to attend these schools (which include some of the most prestigious public universities) can no longer bank on test scores to help them gain admission.

Every college wants to increase its yield which is the proportion of admitted students who ultimately attend the school. Early decision, where admitted students must decide to attend by December whether to attend the school. Top schools are also making use of waitlists to keep acceptance rates artificially low. Students put on a waitlist are in a “limbo” status between accepted and rejected. Those who commit to other colleges will ask to be removed from the waitlist, while those who remain interested stay on the list.

Colleges fill up their incoming classes with “waitlisted” applicants if too few people who were originally accepted decide to attend. The National Association for College Admissions Counseling (NACAC) reports that 43% of schools use waitlists with 20% of waitlisted students ultimately gaining admission to the institution. However, the waitlist process offers an outsized benefit to selective schools that can fill up most of their spots while maintaining a super-low acceptance rate.

If they need a few more students to fill a class they can make target offers to qualified students who weren’t originally accepted.

Given the increasingly competitive landscape, students who want to attend a top school feel the need to apply to more schools to gain admittance to at least one selective school. At the same time, top schools are getting inundated with more top candidates than ever before. This vicious cycle could continue to drive applications up and acceptance rates down.

But the story at the top schools isn’t the story everywhere. NACAC reports that overall admittance rates are up from their 2012 lows, and most schools are fighting over fewer students who will ultimately enroll in college.

If you’re a current high school student, you probably don’t need to worry that no school will accept you. Even average students can gain acceptance to less selective schools, community colleges, and some selective schools. If you have your heart set on a selective school, you need to be willing to play the numbers game. Without a systematic change to the college admissions process, you can’t be assured of admittance to selective schools even if you’re a top student. That leaves you applying to half a dozen or more schools in the hopes that one will let you in.

But top students should remember that entry to a selective school isn’t a guarantee of financial wellness. You may want to consider less selective schools that offer more generous scholarships and grants to help you cover the cost of your undergraduate education.

Editor: Colin Graves Reviewed by: Robert Farrington

The post Why Are College Acceptance Rates Decreasing? What You Need To Know appeared first on The College Investor.

Embarking on the journey to higher education is a life-changing decision. One of the first and biggest challenges many prospective students encounter is whether to pursue a college education in-state or out-of-state.

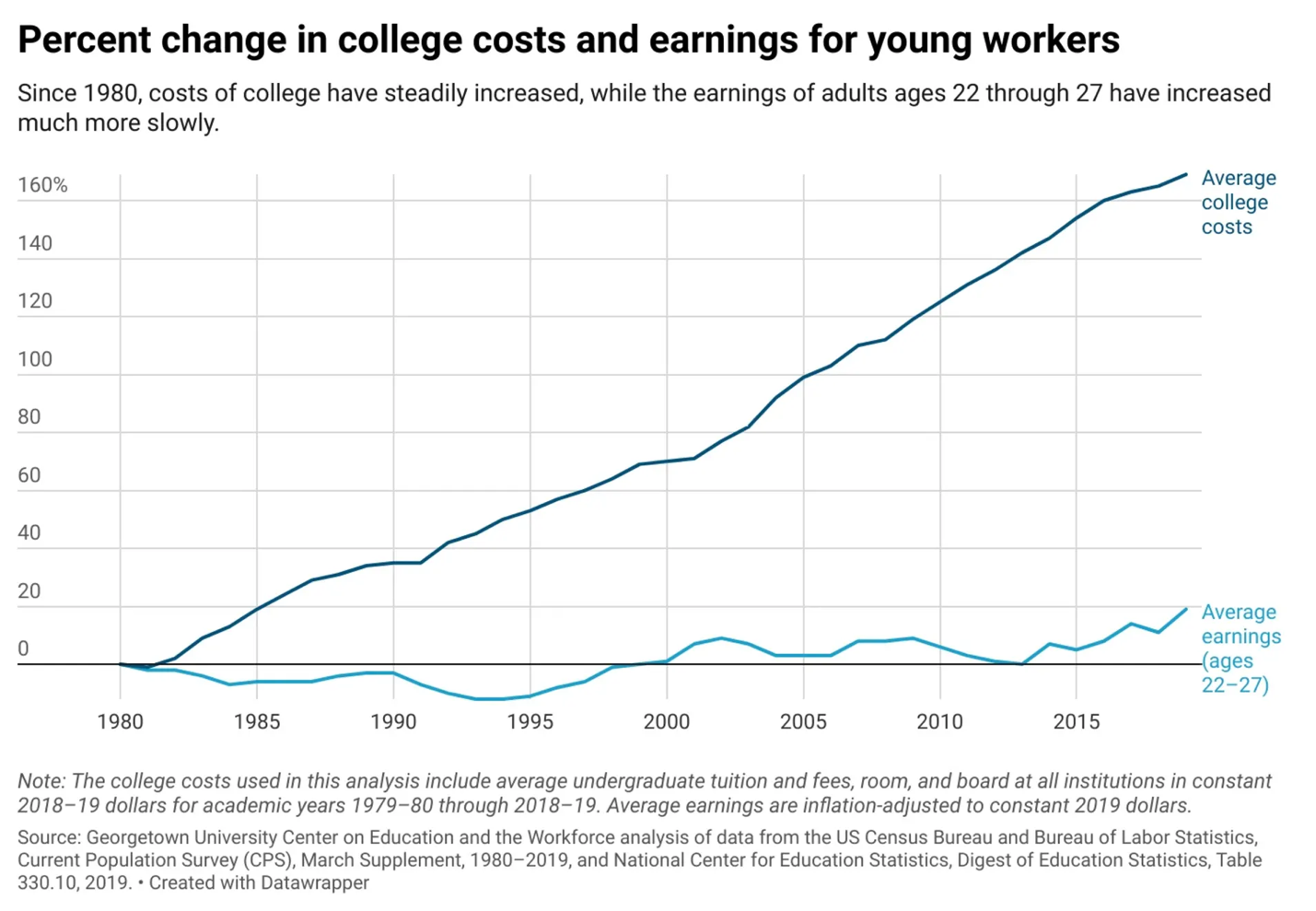

As you know, the average cost of tuition has been on an upward trajectory since sometime around the 1980s. College tuition at a public four-year university increased 9.24% between 2010 and 2022, averaging a 12% increase each year in that period.

Not only does higher tuition mean greater costs for education, but it also means greater likelihood of finding yourself graduating with larger student loans. This is particularly concerning when the average student loan debt of recent graduates is $33,500.

In this article, I’ll dive into the reasons why opting for an in-state college might prove to be a better long-term decision for you. From location and affordability to in-state benefits and quality of education, I aim to shed light on the advantages of keeping your educational investment in-state.

First, a quick overview of the pros and cons of staying in-state:

Whether or not you’re the first person in your family to pursue a higher education, there are a few important things to keep in mind, beginning with common terms used when discussing the overall cost of attending postsecondary school.

Tuition: The cost of attending college classes. Some colleges charge one set tuition rate, while others charge per credit hour. Tuition is often different for resident vs. non-resident students.

Fees: There are almost always additional charges to cover the cost of your classes, such as additional course materials or a lab fee.

Direct Costs: These are costs paid directly to the university, such as tuition and fees, housing, and a meal plan.

Indirect Costs: These are educational costs not paid directly to the university, such as textbooks, transportation, and other personal expenses associated with your education.

Cost of Attendance: This is the maximum amount of money an academic institution costs to attend for one year, before any financial aid is applied. This includes both direct and indirect expenses.

Net Price: This is the amount you pay to attend an academic institution for one year, after any financial aid has been applied. Net price calculators are a useful feature where you can enter information about yourself to find out what similar students paid to attend the same university the previous year, after taking grants and scholarships into account.

Understanding the full cost of attendance at a university will help bring your financial picture into perspective, identifying how much financial aid is needed and the extent of any out-of-pocket expenses you face. Now that we’ve gotten basic terms out of the way, here’s a look at why knowing your costs is so important in the long-term.

To be clear, median earnings of early-career professionals with a bachelor’s degree or higher have been growing. However, we’re seeing the average cost of tuition increase almost 10 times faster than average earnings, and you don’t need a college degree to recognize the gross imbalance that creates. Rising tuition rates is one of the greatest contributing factors to the high student loan debt experienced in recent decades. It begs the question: How much debt are you willing to take on for your four-year degree?

The cost of education remains a significant financial challenge for most families, and the last thing you want to do is underestimate your dues. One way to fully understand the current weight of tuition is to look at the cost of attending the flagship school in each state. I guarantee if you compare in-state and out-of-state tuition at a handful of flagship schools across the country, you’ll start to notice a pattern. (This data was found at TuitionFit and IPEDS.)

Also, when researching tuition rates, I also noticed that some schools set different rates for lower-classmen vs. upper-classmen. Make sure to do your own research and ask around to uncover any hidden costs you’ll be hit with later.

Remember, your first year of college is also typically the least expensive year. Tuition and fees usually rise every year. You could be paying substantially more your last year of college than your first.

Let’s start by comparing average tuition across all four-year public universities in the U.S. with average tuition of only the flagship school in each state.

Header | Average In-State Tuition | Average Out-of-State Tuition |

|---|---|---|

U.S. Overall State Average, 2022-2023 | $11,103 | $27,2715 |

U.S. Flagship-Only Average, 2022-2023 | $12,486 | $33,770 |

What does this tell us? Right away, you see that average out-of-state tuition is higher than in-state tuition, though what’s more telling is just how high out-of-state tuition is at a flagship university.

Average out-of-state tuition at a flagship university is more than $6,000 higher than average out-of-state tuition at a non-flagship university. This instantly tells me states are slapping on a “premium” for attending their flagship university.

Not convinced? Take a look at average annual tuition rates for 2022 -2023 across some of the most popular flagship schools in the U.S. and keep an eye on that premium I mentioned.

University | In-State Tuition | Out-of-State Tuition | Out-of-State Premium | Out-of-State Premium (as a percentage) |

|---|---|---|---|---|

U. of Alabama | $11,940 | $32,300 | $20,360 | 271% |

U. of Arizona | $13,260 | $39,560 | $26,300 | 298% |

UC Berkeley | $15,200 | $46,250 | $31,030 | 304% |

U. of Colorado at Boulder | $13,110 | $40,360 | $27,250 | 308% |

U. of Florida | $6,380 | $28,660 | $22,280 | 449% |

U. of Michigan - Ann Arbor | $16,740 | $55,330 | $38,590 | 331% |

UNC Chapel Hill | $9,000 | $37,560 | $28,560 | 417% |

Ohio State University | $12,490 | $36,720 | $24,230 | 294% |

U. of Texas at Austin | $10,860 | $38,650 | $27,790 | 356% |

U. of Virginia | $18,240 | $54,390 | $36,150 | 298% |

The out-of-state tuition rate at flagship schools is at least twice the in-state tuition rate and, in some cases, three or four times the in-state tuition rate.

According to Mark Salisbury of TuitionFit, "Flagship universities see out-of-state students as cash cows and don't feel any obligation at all to make themselves financially feasible for out-of-state students."

Average out-of-state tuition is already 172% more than in-state tuition among public institutions. Is it worth it? I’ll dive into that next.

Submit your financial aid award to TuitionFit and see if you are getting a fair offer! And help others know the “real” numbers as well. Check out TuitionFit here >>

Knowing how much higher out-of-state tuition and fees are compared to in-state rates, choosing to attend an out-of-state school instantly increases your financial burden, and you may find fewer opportunities for financial aid, grants, or scholarships.

TuitionFit data from students accepted by out-of-state public institutions shows that out-of-state students get proportionally smaller merit aid awards. Plus, you’ll need to factor in the cost of living in a new state, as well as the cost to travel back and forth to see family.

Don’t quietly rule out in-state schools because of a myth that out-of-state schools offer a better education. In-state schools have comparable quality of education and academic offerings, and many are reputable enough to warrant your interest and research.

Moving to a new place can be emotionally distressing – take it from someone who’s been there. Going out-of-state means removing yourself from your immediate support network, which can feel isolating at such an important time in your life. Staying in-state may make it easier to travel back home or to commute from your current residence.

Attending college in your home state can often provide easy access to networking opportunities, growing existing relationships and forging new ones as a result. Having strong connections can make a difference in the types of opportunities you receive, especially when you’re ready to start your career.

Like being in a new location, adapting to a new culture or climate can be tough. There are many new things to see and do, but exploring a new environment can be scary. Be honest with what you value in your current community and whether you’ll be able to find those same aspects elsewhere.

There are times when going out-of-state makes sense, but it’s often for very specific circumstances. That might include:

There are also states that offer tuition reciprocity for universities located in neighboring states. For example, the Western Undergraduate Exchange can be used by students in Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, Nevada, New Mexico, North Dakota, Oregon, South Dakota, Utah, Washington, and Wyoming. Check the regulations in your state.

The importance of reasonable and manageable tuition really can’t be overstated because it directly influences your present and future wellbeing. Keeping tuition low not only prevents you from incurring excessive debt now, but it also minimizes your monthly minimum payments later – a time when you’ll have other costs to concern yourself with.

I’d be remiss if I didn’t at least briefly discuss the impacts of student loan debt here. While some student loan debt can actually be a good thing, here are a few points to consider before signing on the dotted line:

As you can see, there are ample benefits to keeping your college education in-state. First and foremost, you save thousands of dollars. But you also maintain your geographical comfort, retain a network of support, and receive a quality education just a stone’s throw from home.

And while tuition at in-state school is much lower than what you’d owe at an out-of-state school, pursuing a four-year degree at any university is a costly endeavor, in general. So, my advice to you is to research the schools near home and find out what they offer.

Editor: Ashley Barnett Reviewed by: Robert Farrington

The post Why You Should Never Apply To An Out-Of-State College appeared first on The College Investor.

Applying to college may be the most stressful thing you've encountered in your life so far. Depending on the college you're applying to, you may have to submit grade transcripts, test scores, evidence of extracurricular activities, essays, and references.

But one thing that colleges will almost never ask you about is your high school attendance. It's important to note that many high schools do include attendance information as part of your grade transcript. However, in almost all cases, colleges will not look at your high school attendance record.

While it's true that most colleges will not look at your high school attendance or tardiness records, that doesn't mean attendance isn't important. You likely won't have to record your previous attendance on your college application, but your attendance (or lack thereof) can manifest itself in other ways which may affect your chances of being accepted into college.

Put another way, college admissions departments are not going to care that you had a doctor's appointment that caused you to miss 7th period math class, or that you showed up late to biology because you were talking to the school counselor. But if you have an extreme record of absence and/or tardiness, that may be something that college admissions departments may notice or consider. Also, it may impact other things that ARE included on college applications.

Perhaps the most obvious scenario where absence can affect your chances of being accepted into college is if extended absence or tardiness starts impacting your grades. While it is not a certainty that poor attendance will lead to poor grades, the two are generally correlated. Extremely poor attendance or tardiness can also impact your ability to actively participate in extracurricular activities.

Most colleges take a holistic approach to the admissions process. This means that rather than putting undue weight on any one area of the application, they look at the big picture for each applicant. While some universities may have a minimum GPA or test score requirement, they may not take the students with the absolute highest grades and/or test scores.

Instead, many college admissions departments look at how each of these factors work together. As part of this holistic admissions process, colleges do not typically care about a small number of absences. However, if you have a large amount of absences (more than 20 or 30 in one school year), ESPECIALLY if that also impacted your grades or other activities, it may make sense to explain any extenuating circumstances on your application. Perhaps you had severe medical issues or family circumstances that impacted your school attendance. While you don't need to write a long "woe is me" explanation, it can make sense to give a short explanation of the situation and state what you've learned from the situation.

While the fact that colleges aren't going to look at your high school attendance mark might help you out if your attendance isn't great, it also means that you won't get any bonus marks for having perfect attendance. No matter what your attendance record is in high school, now is a good time to start preparing for the differences between attendance in high school and college.

In high school, attendance is generally mandated by law and required. You may have to provide a written excuse for any absence or tardiness, and unexcused absences may be punished. In college, the opposite is generally true. While some classes may require attendance, most college professors do not take attendance and do not care if you are in class or not. While that might SOUND great, many college freshmen take a lax approach to actually going to class and get a rude awakening come exam week.

In summary, the most common things you'll need to provide on college applications include your grades, test scores, personal essays, and extracurricular activities, not your high school attendance.

Most colleges take a holistic approach to the admissions process, which means that they look at the bigger picture of each applicant. So while they may not be counting up your unexcused absences, they are likely to notice if you have an extreme amount of absences that are affecting your grades, test scores, or participation in extracurricular activities.

Editor: Colin Graves Reviewed by: Robert Farrington

The post Do Colleges Look At Your Attendance? appeared first on The College Investor.

As someone who spent her freshman year at the University of Alabama (UA), I know firsthand how costly simply attending two semesters of classes can be there. Add to that the experience of Greek life, and your social circle isn’t the only thing that suddenly expands.

Sorority hashtags and content exploded on social media in August 2021, as universities eased Covid-19 restrictions and let students resume fall recruitment activities. This was especially true for UA, which is often used as the benchmark for recruitment across the country due to its size and funding.

Earlier this year, Max (formerly HBO Max) released a documentary that examines UA rush through a magnifying glass. Whether you’ve seen the documentary, enthusiastically followed the #BamaRush trend, or you’re simply curious about the price that’s paid for Greek life, this article is a good starting point for learning about the true costs of sorority recruitment.

I’ll break down the rush process, point out its main financial factors, and weigh the pros and cons of taking on Greek life.

The purpose of Greek life on campus is noble enough: These organizations bring like-minded people together and allow them to explore new opportunities, give back to their community, and bond over shared commitments and responsibilities. Many find that the Greek system helps them build an identity on a large campus and, at the same time, form deep relationships with those who are in the same walk of life.

Also referred to as “recruitment,” rushing is the journey that potential new members (or PNMs) embark on to meet with and be recruited by sororities in the hope that they’ll eventually be selected by one to join. During rush, PNMs meet with all participating sororities on campus to, essentially, be interviewed for how well they fit with the organization. The term “rushing” comes from the notion that sororities are rushing to show themselves as the best on campus and attract the best members.

Recruitment typically occurs in the fall and spring for many universities, with fall rush being the biggest recruitment period each year, mainly because it’s the start of the academic year. Some schools host recruitment a few weeks prior to classes starting, while others hold it shortly after classes have started. Either way, the typical rush cycle happens sometime between August and October each year.

During rush week, you’ll experience multiple themed rounds as you get to know each sorority and vice-versa. Rounds are often shorter at the start of the week and longer near the end, as sororities narrow their lists of PNMs and invite them in for a more intimate look at their sisterhood. Likewise, the number of houses a PNM visits lessens each day, as you also rank each sorority after interacting with them.

Here's what your week might look like:

We all know sororities are assessing you based on what you bring to each visit. But what does that really mean? What’s most important to them? As you read through this list, keep in mind that it’s just as important that you assess how each chapter fits with your own interests.

Here are some sample questions you’ll want to be ready to answer:

When you answer these questions, think about how your answers convey your personal qualities. Some of the top qualities sororities are interested in are:

@yourrichbff The cost of Bama rush! #college #student #school #university #studentloans #studentdebt #navient #major #bamarush #bama #bamarushtok #greeklife #bamarushweek ♬ original sound - Vivian | Your Rich BFF

Here’s a breakdown of each area you should be ready to spend money on in your first year of sorority life:

If you’ve decided to go through recruitment, I hope you are ready to get “glammed to the gods.” Sorority OOTD (Outfit Of The Day) videos gained a lot of traction on #RushTok during the fall 2021 recruitment period, highlighting the lengths some PNMs go to in order to stand out.

The popular clothing brands worn by PNMs during recruitment come at a price. And trust me, you will feel pressured to be seen wearing the same brands as your peers. Favorite items include Altar’d State tops (about $35 to $80 or so); Kendra Scott jewelry ($40 to $200); Lily Pulitzer floral-print dresses ($100 to $300); and Steve Madden shoes ($50 to $350).

Remember those rush themes I mentioned? This is where they start to hit your bank account, because you are also expected to play the part and curate a themed outfit for each night of recruitment. The combined cost of rush clothing may come to about $450 for the week, assuming you borrow some items from friends and keep new purchases on the cheaper side.

All members pay dues each semester, though these fees vary by the chapter you choose.

Expenses you should expect on an annual basis include chapter fees as well as room and board if you choose to live in the chapter house. One-time new member fees for pledging, initiation, and receiving your sorority pin increase first-year costs.

Average new member dues at UA for the 2023-2024 academic year are $4,165.59. Note that some chapters have scholarships or grants for members based on financial need or academic merit, though these are typically available for existing members only.

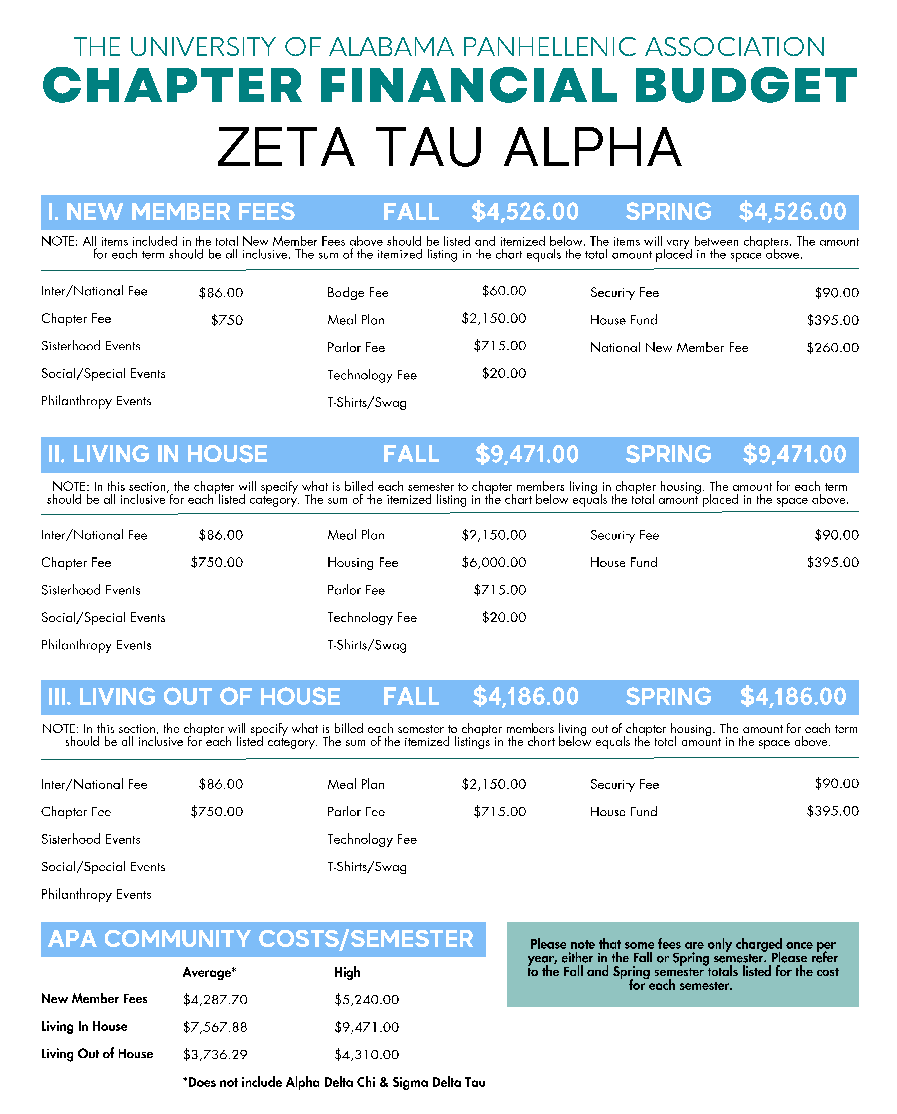

Want a breakdown of costs? See the financial budget below for one of the top-rated sororities at UA.

Regardless of whether you live in the chapter house or off campus, housing costs will add a substantial amount to your first-year expenses.

Note that living in a chapter house can potentially be more expensive than sharing a dorm or house with roommates elsewhere. However, living in-house also has the added benefit of being on or near campus, which creates ample social opportunities. And, perhaps most importantly, it gives you nearly all-day access to freshly prepared meals thanks to your chapter’s private chef.

Still, fees for living in-house during UA’s 2023-2024 academic year average $7,355.82 each semester. Compare that with the cost of living out-of-house, which averages $3,696.35 each semester. Should you choose not to live in-house, you are typically still required to pay for the chapter’s meal plan each term.

Don’t forget that there’s often a one-time, nonrefundable fee just to register for recruitment. At UA, that fee is $375, and it covers the cost of recruitment publications, use of campus facilities, transportation around campus, and a few recruitment T-shirts.

Adding up all the above expenses leads to an alarming result. All in all, you’re looking at an average new member cost of about $4,166 each semester, or $8,332 for your first year. After your first year, that total increases if you decide to live in the chapter house and decreases slightly if you choose to continue living outside it. Don’t forget, those averages are on top of the cost of attending your university.

You’re looking at an average new member cost of about $4,166 each semester, or $8,332 for your first year.

Plenty of students gravitate toward the ample opportunities that Greek life offers. But it’s important to carefully consider what you want out of this potential chapter in your life and if its associated expenses are worth its benefits.

If your heart is set on rushing, I recommend at least creating a budget ahead of time to consciously plan your spending. After all, while Greek life may be a good investment in yourself, there’s no need to go into significant debt for it.

If your sorority dues exceed your school’s cost of attendance, you can’t use federal or institutional financial aid to cover the gap. So, if needed, research scholarships that might be available to you based on your academic profile. And reach out to see if the sorority offers its own internal scholarships or gradual payment plans. Also, consider other ways you may be able to save money elsewhere as a student, like splitting the costs of streaming services, cutting your cell phone bill, and buying items used instead of new.

Remember: Going through recruitment doesn’t promise you a bid at the end. So take time to really think about whether you’re ready to invest your money upfront in something you may end up walking away from.

Editor: Ashley Barnett Reviewed by: Robert Farrington

The post How Much Does It Cost To Rush? (Based On Real Bama Numbers) appeared first on The College Investor.

There are three main options for college admissions applications: early action, early decision, and regular decision.

Early decision applications involve a commitment to enroll if admitted. In contrast, early action is non-binding.

Students who are admitted early action are not required to accept the offer of admission. They may accept or reject the offer of admission at the same due date as the regular admission pool, typically by May 1.

Students who apply for early decision are limited to applying to just one college. Students who apply for early action may be limited to applying to just one college, called single-choice early action or restrictive early action.

In some cases, restrictive early action colleges will allow early action applicants to apply early action to public colleges but not other private non-profit colleges. Some colleges with non-restrictive early action say that they do not share information about their early action applicants with other colleges, allowing the student to apply early action to more than one college.

Here's a full breakdown of early action vs. early decision vs. regular admission.

When students apply for early action or early decision, they must submit their applications by an earlier deadline. They learn the admissions decision before the regular admission deadline. This allows them to apply regular decision to other colleges if they don’t get in early.

Early action and early decision typically have application deadlines on November 1, with notification in mid-December. Regular decision typically has deadlines in January or February, with notification in March or April.

Some colleges may have different deadlines, such as early admission deadlines in mid-November or as late as mid-October and regular decision deadlines as early as December 1. Some colleges even have multiple early action and early decision deadlines.

About 180 colleges offer early decision and about 310 offer early action, for a total of 490 colleges offering early admission. Noteworthy colleges that offer early decision include:

Noteworthy colleges that offer early action instead of early decision include:

Lastly, the following colleges offer both early decision and early action:

There are several advantages and disadvantages to each option for early application.

With both early decision and early action, there is the potential for less stress if the student is admitted early. Getting in early provides peace of mind, knowing that you were accepted somewhere. On the other hand, the student’s stress may be magnified if their early admission application is rejected or deferred to the regular admissions pool.

The earlier application deadlines, however, provide the student with less time to write and improve their application. It may also provide less time for the student to get feedback on their application. This can be an added source of stress. On the other hand, early action applications provide students with more practice on their college admissions essays and college interviews, potentially improving their later regular decision applications.

Applying early may also prevent students from taking the November and December SAT and ACT tests, which may be important if they want to improve their admissions test scores.

Early admissions rates are higher than for regular admissions. Some students believe that applying early increases their odds of admission. But, the higher admissions rates may be due to a self-selecting group of higher-quality and wealthier students. Recruited athletes may also be counted in the early decision acceptance pool, skewing the statistics.

Applying early is also a form of demonstrated interest, which increases the likelihood that the student will enroll if admitted. It can signal that the college is the student’s first choice.

Early decision involves a commitment to enroll, while early action does not. Early action provides the student with more options.

Early action allows the student to shop around for a college with the best financial aid offer (lowest net price). Early decision does not. So, early decision is not suitable for low-income students, which may also include many underrepresented and first-generation college students, especially since most early decision schools do not meet the student’s full demonstrated financial need.

High-income students are twice as likely to apply early decision as low-income students, according to the Jack Kent Cooke Foundation.

Net price can vary significantly among colleges. So, even if an early decision student will get the same aid offer as they would receive if they applied regular decision, the college may have a higher net price than other colleges. If a student needs to compare colleges by affordability, they should not apply early decision.

Many students apply early to their dream college. If they get in and receive an affordable financial aid package, they’re done. But, dream colleges tend to be more competitive, so they are less likely to get in early.

A better strategy may be to apply early action (not early decision) to a college where the student is likely to get in early, to eliminate the need for safety schools. This can save a lot of money on application fees.

In addition to applying early action to one college, students may wish to submit their regular decision applications by the early admissions deadline, especially at early decision colleges. This may be interpreted by the college as demonstrating strong interest in the college.

Early decision colleges try to intimidate students into thinking that they can’t back out of an early decision commitment. They may require the student, parent and school counselor to sign an agreement in which the student commits to enroll in the college if admitted through the early decision application.

But, such an agreement is not legally binding. If the college tried to enforce the commitment by notifying other colleges, it would violate antitrust law. It’s a form of price-fixing and collusion.

Common reasons for backing out of an early decision commitment include an inadequate financial aid package (e.g., the net price is much higher than the estimate provided by the college’s net price calculator), family emergency, serious illness or a death in the family.

Most early decision colleges ask the student to give them the opportunity to improve the financial aid offer first, but will release the student from the obligation to attend if they cannot afford to enroll.

Editor: Colin Graves Reviewed by: Robert Farrington

The post Early Action vs. Early Decision: What You Need To Know appeared first on The College Investor.

College applications present students with a challenging and time-consuming project — perhaps the largest they have faced in their lives. As a parent, you can help your child manage the process, but you can also hurt their chances if you make the wrong moves.

Here’s a collection of college admissions secrets that can help you craft the ideal college list, get your child into schools they love, and choose one that you’ll be able to afford.

Too often, a teenager gets their heart set on just one dream college. It’s that college or none in their view. But, if they don’t get into their dream college or can’t afford its price tag, it can lead to severe disappointment and even depression.

About a quarter of high school seniors do not get into their first-choice college. Of those who do get into their first-choice college, a quarter do not enroll. According to the American Freshman survey conducted by UCLA’s Higher Education Research Institute in 2019, only about 55% of college freshmen said they were enrolled in their first-choice college. But that number increased to about 93% for those who were enrolled in their first-, second-, or third-choice college.

Instead of focusing on just one college, parents should encourage their children to pick three favorite colleges at different price points and apply to those. That way, students are more likely to get into a college that they want to attend and that their parents can afford.

Related: What Is The Average Cost Of College?

Academic fit measures the extent to which a student’s academic performance is typical for the college’s general student body.

Most colleges’ websites will include information about the 25th and 75th percentiles for their freshman class’s SAT and ACT scores. You can use that range to determine if a college is a match, reach, or safety school for your student.

Craft a preliminary list of colleges that includes mostly match schools but also a few safety and reach schools. Don’t apply only to reach schools, as there’s a good chance your child won’t get into any of them.

Students too often apply to a college that is more expensive than their parents can afford, which will burden both the student and parents with too much education debt. But it’s actually fairly easy to determine if a school makes financial sense for your family.

Use a college’s net price calculator to get a personalized estimate of its one-year net price. The net price is the difference between total college costs and gift aid, which consists of grants and scholarships. That difference represents the amount you will have to contribute from savings, income, and education debt to pay for a school.

Once you know a college’s net price, you can determine if it’s a financial fit by using my college affordability index, which is the ratio of a college’s one-year net price to your total annual income. If the one-year net price is more than a quarter of your total annual income, your family will likely have to go into an unaffordable amount of debt to pay for the college.

A few other tips for keeping college costs down include:

An in-state, public college will often be among the least expensive postsecondary education options out there. Encourage your child to include at least one in-state college on their shortlist.

Colleges with generous “no loans” financial aid policies, which replace loans with grants in the financial aid package, are also among the more affordable options. But most of these colleges have a minimum student contribution or summer work expectation, which limits the amount of financial aid that low-income students will actually receive.

If the college has need-sensitive admissions, don’t skip applying for financial aid and think you can wing it for a year. Often, colleges with need-sensitive admissions policies will not provide grants to students who didn’t apply for financial aid as freshmen unless the student can demonstrate a significant change in financial circumstances.

And apply to a few colleges that use the FAFSA for awarding their own financial aid funds, not just colleges that require the CSS Profile. There can be significant differences in the financial aid packages among the two types of colleges.

Too many students wait until the last minute to submit their college applications. But a lot of things can go wrong if a student waits until the deadline to submit. Submitting an application early can help your child stand out and demonstrate that they are genuinely interested in the college.

But don’t apply early decision to any college. Early decision commits your child to enrolling if they are admitted, and you should never commit to a college before you’ve even seen the financial aid package it will offer. If you discover that a college is genuinely unaffordable, you may be able to break the early decision commitment, but it won’t be a comfortable conversation with the admissions committee.

The National Association for College Admission Counseling (NACAC) runs an annual survey in which it asks college admissions officers about the most critical applicant characteristics they look for during the college admissions process.

These criteria generally fall into three groups:

The purpose of assessing a college application is to determine whether the student is capable of academic success at the college. Students with good high school GPAs and high standardized test scores are more likely to graduate from college.

But, at the most selective colleges, the impact that a 1500 SAT score versus a 1600 SAT score will have on an admissions committee’s decision may be minimal. These colleges instead rely on non-academic factors to differentiate among their top applicants.

When two students have comparably strong grades and test scores, admissions factors that are normally considered less important — like who engages in more impressive extracurricular activities — suddenly become deciding factors.

But depth matters more than breadth. It is better to do one thing well for many years than many things superficially for a shorter period of time. So don’t spread your child too thin with their extracurriculars, and help them choose activities that they are passionate about and/or that can make a difference in your community.

Entrance exams have a big impact on college admissions, especially at second-tier institutions.

Practicing can help improve a student’s entrance exam scores. It teaches them test-taking strategies and reduces the likelihood that they’ll freak out on the day they take the test. Diagnostic tests can also identify weaknesses, where a little practice can improve your performance and help eliminate careless errors. A gain of 50 to 100 points on the SAT is not uncommon with some practice.

Good study guides with practice tests include those issued by Barron’s and the Princeton Review. These books also teach test-taking strategies and approaches to answering particular types of questions. You can also get official SAT practice tests through Khan Academy. You can also hire tutors to help your student prepare for the entrance exams.

A test-optional college considers standardized test scores if provided, but doesn’t require them. That’s different from a test-blind college, which does not consider standardized test scores, even if they’re provided by the student.

Students who have a good SAT score or a good ACT score (or both) have an advantage with test-optional college admissions committees.

Colleges don’t want to accept students who aren’t sincerely interested in attending their institutions, since that lack of interest may negatively affect a college’s yield (the number of students who ultimately enroll). Just as students get nervous about whether they will or will not get in, college admissions officers get nervous about whether their admitted applicants will or will not accept their offers of admission.

Demonstrated interest provides the college admissions office with a way of predicting whether a student will enroll if admitted, as students who interact more with the college are more likely to enroll.

Some of the best ways to demonstrate interest include:

Sending thank-you notes to admissions officers also helps. But don’t overdo it.

If your child has trouble writing essays, have them answer the essay prompt aloud while recording the answer, then transcribe the recording. This works because most people speak at about 100 to 200 words per minute but can write or type at about 40 words per minute. So, the act of writing interferes with the flow of thought. Answering the question aloud will yield a more fluid and passionate essay, making it more interesting.

After you’ve transcribed the recording, create an outline from the transcript. This will help organize your child’s thoughts and add structure to the essay. Keep the following in mind while developing the outline.

Admissions committee members have just 10 minutes to go through a student’s entire application, and they may not read more than the first paragraph of a student’s essay. So, the reader’s attention needs to be hooked early on.

When creating the outline, go through the transcript and pick out the most important and thought-provoking points that were made. Use the inverted pyramid style of writing and present the best content at the beginning of the essay.

Make use of narratives in which the student had an impact on other people, and other people had an impact on the student. This makes the essay personal and will help your child’s personality shine. Construct the narratives with specific examples, not generalities. The admissions reader can use those examples to champion your application.

Never write about a mental health condition, a serious illness, or bad behavior. Don’t give the admissions reader an excuse to reject your application. Focus on the positive, not the negative.

And proofread your essay multiple times before submitting it. Print it out and then read it aloud. Mark any place you stumble, because that may be a sign of a problem.

When considering whom to approach about a letter of recommendation, think about teachers who can both write well and write well about your child, specifically. And don’t have your child simply ask their teacher to write a letter of recommendation. Instead, have them ask their teacher if they can write a great letter of recommendation. This gives the teacher an out if their letter will be less than enthusiastic.

If you find a great educator who’s willing to provide a letter of recommendation, keep in mind that you want that letter to align with the rest of your child’s application. Give the teacher a copy of your child’s accomplishments resume that lists some of your child’s honors, awards, hobbies, sports, student activities, volunteer activities, jobs, and summer activities. This will provide the educator with facts that they can weave into their recommendation to make it seem like they know your child better than they do. But be selective in what you include in that resume, and keep it to just one page.

If a college admissions committee is on the fence about a student’s application, its members may visit that student’s social media accounts.

Before you submit a college application, preemptively review your child’s online presence and ask them to delete any inappropriate or offensive material. Eliminate any signs of bad judgment, drug and alcohol use, or a negative attitude.

When your child communicates with admissions staff, remind them to use a professional email address based on their name, not based on an inside joke or innuendo.

Parents too often try to relive their college years vicariously through their children. They then become overly involved in the college admissions process and may be perceived as “helicopter” or “bulldozer” parents by the admissions committee. This can cause the application for admission to be rejected.

Just as you need to learn how to say “no” when your child picks a college you can’t afford, you also need to learn how to say “no” to yourself.

Back off.

Let your child demonstrate their maturity and take the lead in the application process. Remember that sometimes it’s best to simply play the role of chauffeur and checkbook and that you should only intervene if you have truly serious concerns.

During the campus visit, let your child go off on their own. Don’t tag along, and don’t look over their shoulder. If you want something to do, go to the cafeteria and offer to buy a random student lunch if they will tell you about their experiences with the school, both good and bad.

Most importantly, listen to your child, comply with their boundaries, and avoid these mistakes:

If your child is admitted to a number of colleges, creating a college decision matrix can help you choose which offer to accept. A college decision matrix is a one-page chart with each college in a column and its important attributes in rows. Gathering all this information on a single page will make it easier to make a decision.

Among the attributes you should consider including in your matrix are:

Assign points to each row based on the importance of each attribute, and allocate them to each winner. Or use red, yellow, and green highlighters to mark each cell in the matrix and count the number of wins for each college. The totals will help you rank the colleges and make a final decision that’s right for both your child and your finances.

Your role as a parent is to help your child stand out from the crowd and guide them towards making a good decision. It's important to be knowledgeable about the college acceptance process and to stay involved. But remember that it's their decision in the end.

Editor: Ashley Barnett Reviewed by: Robert Farrington

The post College Admissions Secrets For Parents appeared first on The College Investor.

Congrats! If you’re reading this article, it’s likely because you’re starting to prepare for your college entrance exams. If you’re like I was in high school, you may have very little idea of what you’re getting yourself into. Rest assured, you’ve come to the right place!

A college entrance exam is a standardized test used to measure your college readiness. Apart from optional written essay portions, entrance exams consist of multiple-choice and fill-in-the-blank questions and focuses on reading, writing, math, and/or science. Each test requires a few hours to complete, with one or more breaks. Test results are then used by college admissions committees to gauge your skills in logic, reading comprehension, critical thinking, and problem-solving.

There are a few different tests you can take to enhance your college applications. While each exam type differs in some way, they all work toward the same goal: helping a school evaluate your educational background. To better understand which test is right for you and how to prepare for it, let’s dive into the many facets of college entrance exams!

The College Board was founded in 1900 to organize the college admissions process used by colleges and universities across the U.S. At its founding, the Board had two distinct goals:

The organization ultimately debuted the SAT in 1926, and other common entrance exams have come into use since then. Many schools today still rely on scores from these same entrance exams nearly 100 years later.

The two most often-used college entrance exams are the SAT and the ACT. Colleges may accept either score to assess an applicant’s eligibility for admission and merit-based scholarships, but the two tests differ in numerous ways. Here’s an overview of how they compare:

Header | SAT | ACT |